BIS Proposes Digital ID, CBDC-Powered ‘Finternet’ as Backbone of New Financial System

TruthUnmuted.org | Jesse Smith

Tim Hinchcliffe | The Sociable | Sociable.co

The finternet will merge into digital public infrastructure where anonymity is abolished, money is programmable & citizens are coerced into compliance: perspective

India’s digital identity architect Nandan Nilekani and Bank for International Settlements (BIS) general manager Agustin Carstens propose creating the “finternet,” which they believe will be “the future financial system” powered by digital ID, programmable central bank digital currencies (CBDCs), tokenized deposits, and unified ledgers.

Written by India’s digital identity architect and Infosys co-founder Nandan Nilekani, and BIS managing director Agustin Carstens, the 44-page BIS working paper “Finternet: the financial system for the future” provides a blueprint for how the finternet could connect multiple financial ecosystems through unified, programmable ledgers.

In their introduction, the authors state:

“We propose the concept of the ‘Finternet’ as a vision for the future financial system: multiple financial ecosystems interconnected with each other – much like the internet” - Nandan Nilekani

“The Finternet would be designed to empower individuals and businesses by placing them at the center of their financial lives. Unified ledgers are a promising vehicle to turn this vision into reality” - Agustin Carstens

Source: BIS

“While unified ledgers could in principle contain any financial asset, tokenized money is a core requirement […] Asset programmability would make it possible to embed adherence to relevant rules and regulations within the tokens and transaction instructions in the system”

Bank for International Settlements, “Finternet: the financial system for the future,” April 15, 2024

Unified ledgers, according to the authors, are a promising vehicle to deliver on the three necessary components for a finternet to operate.

Those components include:

- An efficient economic and financial architecture

- The application of cutting-edge digital technology

- A robust legal and governance framework

With unified ledgers being key to a functional finternet, let’s take a look at some of the characteristics and features of unified ledgers.

“‘Unified ledgers,’ an important building block of the Finternet, are a promising vehicle to turn our vision of an efficient future financial system into reality”

Bank for International Settlements, “Finternet: the financial system for the future,” April 15, 2024

Source: BIS

“The ledgers would also include the information necessary for their operation, such as the data required to ensure the secure and legal transfer of money and assets (eg digital identity and laws, regulations and rules governing transactions) as well as real-world information sourced from outside the ledger”

Bank for International Settlements, “Finternet: the financial system for the future,” April 15, 2024

According to the report, unified ledgers are “are digital platforms that bring together multiple financial asset markets – such as for wholesale tokenized central bank money, tokenized commercial bank deposits and other tokenized assets, including company shares, corporate or government bonds and real estate, to name just a few – as executable objects on common programmable platforms.”

In one sentence, we see how unified ledgers can facilitate the use of CBDCs (tokenized central bank money) on programmable platforms.

The report also highlights how “BIS Innovation Hub projects have focused on connecting existing systems and new ones such as central bank digital currencies (CBDCs)” in a section called “contributions from the BIS Innovation Hub to an architecture for unified ledgers.”

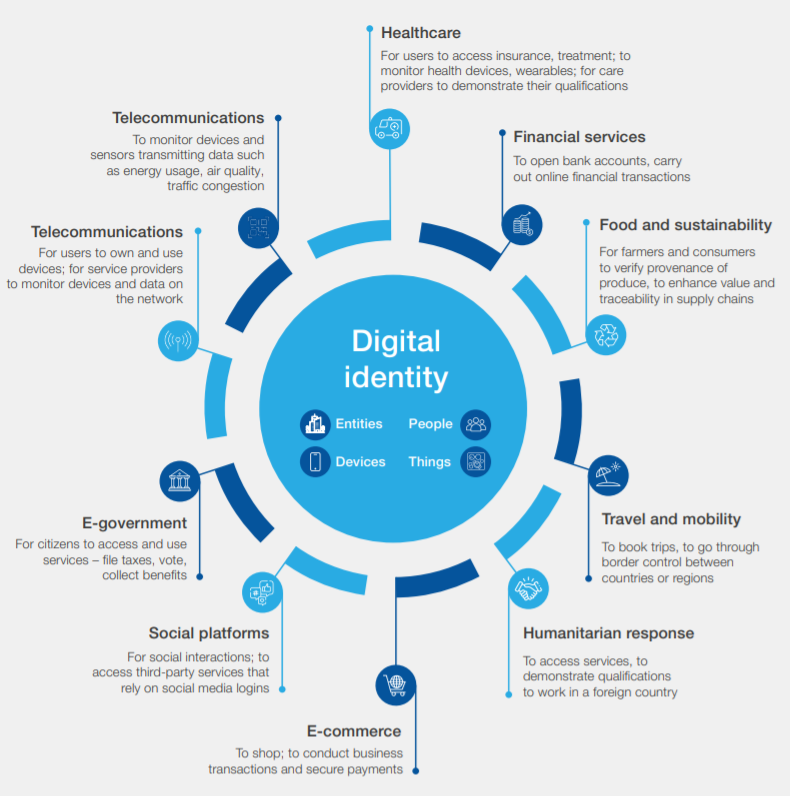

And digital identity is central to everything.

The Finternet “leverages existing infrastructure, including identity systems, digital signature certificate systems, connectivity, registrars and registries, and digital public infrastructure, along with any other reusable services available within a jurisdiction”Bank for International Settlements, “Finternet: the financial system for the future,” April 15, 2024

According to the report, “For financial transactions, establishing trusted user identity is important. Trusted identity, crucial for both natural and legal persons, is anchored in verifiability, using digital signatures to accurately authenticate participants’ identities.”

Additionally, “identity is central to the enforcement of rules and policies within the system, necessitating features like traceability, accountability and observability directly tied to identity management.”

The concept of a finternet fits perfectly within the globalist vision to rollout digital public infrastructure (DPI) throughout the world.

DPI is a civic technology stack that includes three basic components:

- Digital Identity

- Fast Payments Systems

- Massive Data Sharing

A finternet would not only serve as the technological and governance foundation for a fast payments system, but it would also incorporate digital identity and massive data sharing in its core design.

“DPI components collectively underscore the benefits that can be realized through the strategic application of the foundational digital principles we highlight in this paper”Bank for International Settlements, “Finternet: the financial system for the future,” April 15, 2024

Nandan Nilekani, co-author the finternet report, is one of the biggest proponents of DPI on the planet.

Speaking on a panel about Digital Public Infrastructure during the International Monetary Fund’s (IMF) Spring Meetings on April 14, 2023, Nilekani said that in order for nations to build out their DPI, every citizen will need three things:

- Digital ID

- Bank Account

- Smartphone

Everything else is built upon those basic components.

“If you think, ‘what are the tools of the New World?‘ — Everybody should have a digital ID; everybody should have a bank account; everybody should have a smartphone. Then, anything can be done. Everything else is built on that”Nandan Nilekani, IMF Spring Meetings, April 14, 2023

Through his philanthropic organization, Nilekani is also connected to the “50-in-5” campaign, which was launched in November, 2023 to accelerate digital ID, digital payments, and data sharing rollouts in 50 countries within five years under the umbrella of digital public infrastructure.

The 50-in-5 campaign is a collaboration between the Bill and Melinda Gates Foundation, the United Nations Development Program, the Digital Public Goods Alliance, the Center for Digital Public Infrastructure, and Co-Develop; with support from GovStack, the Inter-American Development Bank, and UNICEF.

The Center for Digital Public Infrastructure is backed by Co-Develop and Nilekani Philanthropies.

Co-Develop was founded by The Rockefeller Foundation, the Bill & Melinda Gates Foundation, Nilekani Philanthropies, and the Omidyar Network.

“CBDCs are central to this effort. Whether in wholesale form – as a type of digital central bank reserve – or retail form – as a digital banknote – it is increasingly clear, at least to me, that these new forms of money will sit at the core of the future financial system”Agustin Carstens, Bank for International Settlements, November 8, 2023

Agustin Carstens, the other co-author of the finternet report, has been pushing for the worldwide adoption of CBDCs for years, and the BIS itself is engaged in several CBDC experiments around the world.

On the same day that the 50-in-5 campaign was launched, Carstens said last November at a BIS event that CBDCs “will sit at the core of the future financial system,” which they is now calling “the finternet.”

Speaking at the BIS Innovation Hub-Financial Stability Institute conference on legal aspects of CBDCs in Basel, Switzerland on September 27, 2023, he claimed, “People want their money to be digital and programmable.”

And at an event in Singapore on February 22, 2023, Carstens called for the creation of a “unified programmable ledger in a public-private partnership” to unify CBDCs, tokenized deposits, and fast payment systems.

“Each token on the Finternet is not only a digital representation of an asset but also carries core data and metadata that detail its characteristics and function, and the rules governing its use”Bank for International Settlements, “Finternet: the financial system for the future,” April 15, 2024

Digital IDs, programmable CBDCs, tokenized deposits, and unified ledgers is what the future financial system will look like if central bankers and unelected globalists have their way.

The finternet will be merged into digital public infrastructure where anonymity will be abolished, money will be programmable, and citizens can be coerced into compliance with a digital flick of a switch.

Source: https://sociable.co/government-and-policy/nilekani-carstens-digital-id-cbdc-finternet/

Original Article: https://truthunmuted.org/report-bis-proposes-digital-id-cbdc-powered-finternet-as-backbone-of-new-financial-system/

Comments ()